A recent report indicates that the recommendation algorithms employed by streaming platforms are significantly contributing to a decline in revenue for Australian artists, despite an overall increase in music spending by Australians. This trend is not isolated to Australia; other English-speaking nations, excluding the United States, are experiencing similar challenges.

Between 2021 and 2024, Australia’s recorded music revenues surged by nearly 28%, rising from USD $417.5 million to $534 million. However, earnings from local artists decreased from $50.9 million to $44.8 million, resulting in a drop in the market share of Australian music from 12% to 8% during the same period.

The report suggests that if local revenues had kept pace with overall growth, an additional $40 million could have been reinvested into the domestic music industry over just three years. It describes Australia as a global example of “market failure” in recorded music, warning that a detrimental cycle could emerge where fewer local success stories lead to diminished investment in the industry, thereby reducing future opportunities for success. The report calls for intervention to address these issues.

The analysis, produced for the public policy think tank The Australia Institute by music economist Will Page and Research Director Morgan Harrington, attributes the problem to algorithmic biases. These recommendation algorithms tend to favor content in the user’s native language, benefiting local music markets with distinct languages. For instance, Denmark has seen a surge in popularity for Danish-language artists, with 16 of the top 20 albums last year being by local artists.

Conversely, in English-speaking countries like Australia, the UK, and Canada, recommendation algorithms predominantly highlight music from the United States, the largest source of English-language music. Former Australian Prime Minister Malcolm Turnbull, who contributed a foreword to the report, noted that streaming platforms have created a global competitive landscape where Australian artists are competing against an extensive American catalog. He described this phenomenon as a “digital one-way valve” that diverts Australian listening habits offshore, highlighting a broader issue of digital sovereignty.

“Australia is now the global poster child for what ‘market failure’ looks like in recorded music.”

Will Page and Morgan Harrington

The UK and Canada are also grappling with similar issues, albeit to a lesser extent. The report indicates that the UK has struggled to produce significant global music successes since Dua Lipa in 2017, with only 30 new artists debuting in the local top 1,000 over the past five years. Canadian artists face challenges due to the dominance of American music, compounded by a “talent drain” where many successful Canadian artists are signed to U.S. labels.

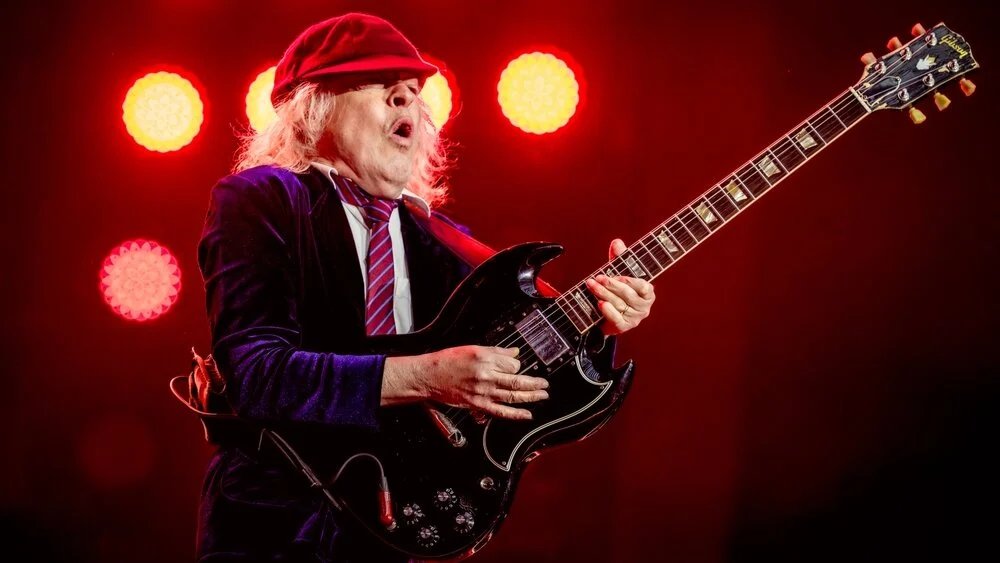

While the situation in the UK and Canada may not be as severe as in Australia, the UK’s cultural influence and legacy acts like Queen and Oasis continue to generate substantial revenue. Canada benefits from government initiatives designed to support its cultural industries, which helps mitigate the problem, alongside the success of artists like Drake and The Weeknd.

The report advocates for Australia to adopt strategies similar to those in Canada, such as the Starmaker Fund, which provides financial support to Canadian artists touring internationally. This fund is financed through fees from private broadcasters, and recent updates to Canadian telecom laws require streaming services to contribute to it, a measure currently facing legal challenges.

“This digital ‘one-way valve’ that sends our listening offshore reflects a broader challenge of sovereignty in the digital age.”

Malcolm Turnbull, ex-Prime Minister of Australia

The report also encourages the Australian government to collaborate with streaming services like Spotify to establish local content curators. These curators could create playlists tailored to specific regions, offering a more personalized approach to music discovery that algorithms may overlook. Additionally, some broadcasters have begun integrating streaming services into their platforms, allowing listeners to add tracks they enjoy to their playlists. In contrast, popular radio stations operated by the Australian Broadcasting Corporation limit listeners to music broadcasted on air or via their less accessible ABC Listen app.

“Why not make more of this great local content available to the world on other platforms, including Apple Music, Spotify, and YouTube, where broader audiences can discover it?” the report questions.

Although the decline in local music has been a concern for Australian politicians for several years, Spotify has countered the narrative by releasing survey results indicating that 85% of Australians are satisfied with their ability to discover new music on streaming platforms. Additionally, 81% of users reported that finding Australian artists is easy, and 61% expressed satisfaction with the amount of Australian music available to them.

“The data tells a positive story: that 81% of listeners feel Australian music is visible, accessible, and easy to explore on streaming platforms,” stated Alicia Sbrugnera, Spotify’s Head of Music Development for Australia and New Zealand. “We recognize that when we enhance the discoverability of new music, we support the entire Australian music ecosystem—artists, venues, labels, and fans alike—and this new research indicates that our efforts are effective.”

Music Business Worldwide